With Congress tangled in a fight to the death over how many lives we need to destroy in order to save us from a budget crisis we might encounter ten to fifteen years from now, I thought I’d put down some thoughts on the deficit and where it came from.

Before beginning, it’s probably helpful to start by saying that the deficit itself has only been around for a short while. At the end of President Clinton’s term of office, we had a surplus of $236 billion.[1] All of that changed with the Bush Administration, but contrary to what a lot of liberals like to think, he is not the sole cause of the recession.

In the very short term, the biggest contributor to the short fall in revenue is the recession. People lost jobs, businesses collapsed, and federal revenue went from 18.5% of GDP in 2007 to 14.8% in 2010.[2]

At the same time, spending went up. When people are unemployed, we pay out much more on unemployment insurance, Medicare, Medicaid, social security (people in their 60s throw in the towel and retire early) and so on.

Add to that the Recovery act under Obama and the TARP under Bush (much of which, however, was later paid back) and Federal outlays grew from 19% of the GDP in 2007 to 24% in 2010.[3]

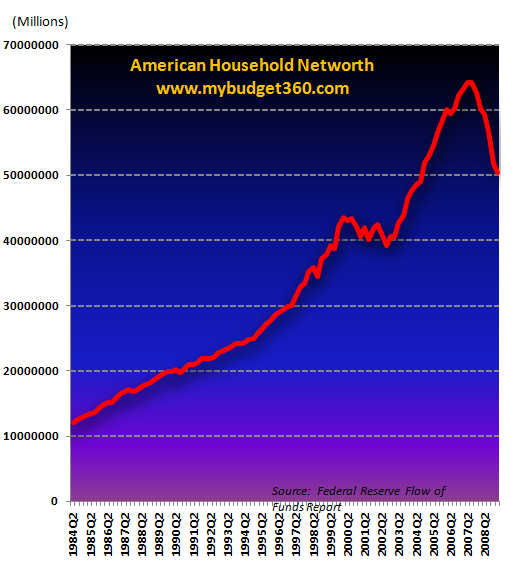

Finally, add to all of that the fact that state and local governments have been firing people at a breakneck pace, driving up unemployment and driving down revenue from taxes. It is estimated that since 2008, as many as 500,000 people have been fired by state and local governments and cut salaries of even more, as a way to help balance their budgets, which is somewhat like bleeding a hemophiliac to see if it will make him get well. The problem in a recession is that a cycle has ended or a bubble has burst and people either have less money to spend or they grow concerned about spending it and the economy grinds down. The way to fix that is to put a lot of money back into the system which adds incomes to some and confidence to others until the machinery begins to run on its own. In this recession, following a small burst of crisis aversion money at the very beginning, our plan instead is to fire even more people and cut even more programs which will make the economic down turn even worse. When the when the housing bubble burst, we lost $4.2 trillion in real estate values. (Yes, that was inflated values, but people trusted it, borrowed against it and based their lives on it, so its loss is a real loss). When you add to that equities, businesses, and other forms of wealth, altogether the US lost around $12.2 trillion since its peak in 2007.[4] So, it’s easy to see how the $300 billion in the TARP program under president Bush (mainly to bail out Wall Street Banks and little for the real economy), and the stimulus package of $789 under President Obama (two-thirds of which were tax cuts to win Republican support and reimbursements to counteract state and local government cutbacks) were only a tiny fraction of what was needed to right the struggling economy.

Other, medium term causes:

Some of of the recession is attributable to the anti-regulation policies of the Bush Administration (a trend which began in the latter Clinton years), some of it is blindness of the Federal Reserve (keeping interest rates too low and allowing the housing bubble to get out of hand) and some of it is the greed and sin of mortgage originators and wall Street gamblers. So, there’s plenty of sin to go around for all of us.

The spikes in the deficit which are most attributed to policies of President Bush are three:

The cost of two unfunded wars.

The Bush Administration said that it would cost between $50-60 billion. Soon after the war began, official government estimates revised it upwards to $1 trillion. Many economists, most notably Linda Bilmes and Joseph Stiglitz,[5] now put the number at over $3 trillion, and say that it will continue to grow for decades. They include not just the fighting itself, but such things as disability payments to wounded veterans and the interest paid on the loans we took out to pay for the wars. More recently, the very well respected Watson Institute for International Studies at Brown University[6] brought together 20 scholars from many fields to bring out the most precise number yet on the costs and they put it at present to be just over $4 trillion, with the additions of interest and health care that Bilmes and Stiglitz included, which are estimated to be just over $250 billion per decade for the next forty years.[7]

The costs of the two major unfunded tax cuts

The Treasury Dept has estimated that costs of making the tax cuts permanent for everyone is $3.7 trillion over 10 years.[8]

The center on Budget ande Policy Priorities says the tax cuts will create almost $7 trillion in deficits from 2009 through 2019, including the associated cost of servicing the debt.[9]

The cost of unfunded Medicare Prescription Drug plan.

The Bush administration won support in Congress for his plan in a very tight vote by claiming that it would only cost $400 billion over ten years. After it passed they recalculated and discovered that they were off by about $800 billion but instead would be closer to $1.2 trillion. Since then projections are as high as $2 trillion.

Many progressives supported this, because there’s nothing wrong with increasing healthcare. But the question why there were no provisions to pay for it, and why the Bush administration blocked the administrators from using free market forces to “jawbone” down prices from the drug manufacturers. It could have been a golden opportunity to start lowering health care costs, but the legislation prevents itself us from doing that.

Speaking of health care…

In the Long term, Health Care is going to be the biggest driver of the deficit.

The costs are rapid and dramatic and will soon be unsustainable. There were a number of provisions in the Affordable Health Care Act that would have slowed its rise, but they were blocked, mainly by members of Congress who receive major campaign contributions from the health care industry (I’m not accusing them of anything, I’m just saying…)

If our health care costs were rising at the rate of the other wealthy countries of the world, we would not be having a long-term problem with health care.[10] (But, then, if we took advice from the rest of the world it would be an attack on the myth of American exceptionalism and it would mean becoming commie socialists and taking care of our own people and we could never live with such a thing.) Social Security, by the way, while slowly running out of money, is not a major driver of our growing debt. Its total shortfall is projected to be 0.7% of total GDP of the next 75 years. That will actually have a very small impact on the budget compared to the recession and tax cuts, which will, over the next decade, consume 1.5% and 2.6% of GDP respectively.[11]

[1] You can download an Excel chart of that by going here: www.whitehouse.gov/omb/budget/Historicals

[2] http://www.cbo.gov/ftpdocs/108xx/doc10871/01-26-Outlook.pdf

[3] Ibid.

[4] http://www.mybudget360.com/the-balance-sheet-recession-42-trillion-lost-in-residential-real-estate-value-yet-mortgage-debt-down-by-140-billion/

[5] Joseph E. Stiglitz and Linda J. Bilmes, “The true cost of the Iraq war: $3 trillion and beyond” (The Washington Post, Sunday, September 5, 2010 http://www.washingtonpost.com/wp-dyn/content/article/2010/09/03/AR2010090302200.html

[6] See “Costs of War” (http://costsofwar.org).

[7] Caring for US veterans, “Costs of War” http://costsofwar.org/article/caring-us-veterans.

[8] “Bush tax cuts: What you need to know,” http://money.cnn.com/2010/09/15/news/economy/bush_tax_cuts_faqs/index.htm

[9] Kathy Ruffing and James R. Horney, “Critics Still Wrong on What’s Driving Deficits in Coming Years Economic Downturn, Financial Rescues, and Bush-Era Policies Drive the Numbers,” June 28, 2010 (www.cbpp.org/cms/?fa=view&id=3036#_ftnref6)

[10] http://www.oecd.org/document/30/0,3746,en_2649_34631_12968734_1_1_1_1,00.html

[11] http://www.cbo.gov/ftpdocs/108xx/doc10871/01-26-Outlook.pdf