The Census Bureau’s annual poverty statistics came out last week and the numbers were ugly. Not only were they (1) uglier than we had hoped, it turns out they are (2) even worse than the Bureau says they are, and (3) they may stay ugly for generations to come.

This week’s blog is a long one because it’s a long subject. If you want to read it, but don’t have much time, read a chunk of two, go drink coffee, and come back later and pick it up. I won’t be offended.

So, let’s take a look at the report.

First, the numbers were uglier than people had hoped.[1]

If you don’t have much time, you have my permission to press print, write the words “bleak” over this section, and then move on to the next.

· Poverty [Incidentally, as a rule of thumb, the government defines poverty as an annual income of $22,025 for a family of four, $17,163 for a family of three and $14,051 for a family of two.]

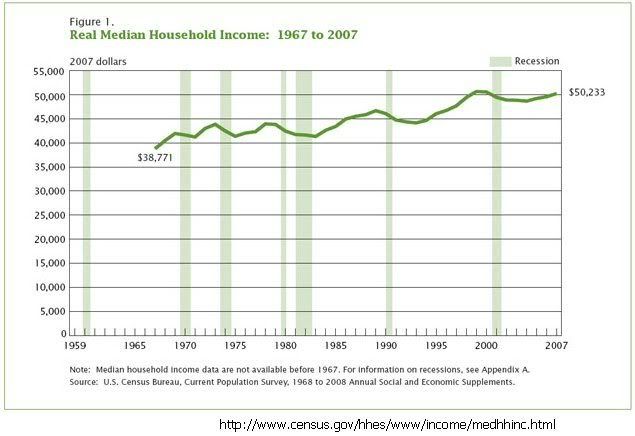

* Real median income declined by $1,860 from 2007 to 2008, a decline of 3.6%, the highest one-year decline in income on record.

* General poverty reached 13.2% in 2008, up from 12.5% in 2007 (and projected to be around 14% for 2009), which is its highest level in 11 years. This increase is because so much of our anti-poverty policies today are for paid work, and the so-called, “safety net” has been cut so much that it no longer does much when the job market is bupkis.

* The family poverty rate rose to 10.3 percent in 2008, up from 9.8 percent in 2007, and projected to be around 11% by the end of 2009.

* Median household income sank 3.6% to $50,303, after adjusting for inflation, and expected to drop at least 5% more this year. That’s more sharply than any time since the government began keeping records in 1947.

A partial racial and ethnic breakdown:

* Non-Hispanic Whites, 8.6 % (17.0 million people) in 2008—up from 8.2 % (16.0 million people) in 2007.

* Blacks, 24.7% (9.4 million) up from 24% in 2007.

* Asians, 11.8 % (1.6 million), up from 10.2 % (1.3 million) in 2007.

* Hispanics, 23.2 % (11.0 million) in 2008, higher than 21.5 % (9.9 million) in 2007. (The large decline in Hispanic income in 2008 is likely related to that group's concentration in the construction industry, which has collapsed due to the bursting of the housing bubble.)[2]

Health care

* Costs continue to soar and in 2008 46.3 million people were uninsured, which was up from 45.7 million in 2007.

* [The unrelenting increases are of course why something like a “Public Option” to force the insurance companies into being more competitive is an absolute necessity for true reform. Not to sound political here, but it is interesting that as more and more people lost their job-related policies and were unable to afford private plans, more and more of them joined the government-controlled, single payer, socialized health care plans. Medicaid and S-Chip climbed from 83.0 million to 87.4 million.

Those hurt worst by the recession

* Worst hit were middle-aged households headed by 45-54-year-olds. They averaged a 5.4% drop in income.

* The only group that actually gained during the last year were people 65 and older, who participate in a radical, socialized, communist inspired, government-run, single payer health care plan and a radical socialized government-run income supplement program. Their incomes rose modestly by 1.2%.[3]

Second, the numbers are even worse than they say they are. The Federal guidelines for assessing poverty are based on ancient, out-of-date assumptions that hide much of the reality of poverty. They were developed in the 1960s and assumed that the average family spent about one third of its income on food. They set the income level for poverty to be the cost of three times a basic market basket of food. (It was later adjusted to five times, but is still just based on food.) However, since then the costs of other things have skyrocketed. What about, for example, child care, gas, commuting, home energy, or housing? All of these items have risen as a percentage of our personal expenses while food has actually gone down. Housing used to be about ten percent of a family’s annual expenses. Now it’s more than thirty. What about health care, which has gone up about thirty-five percent faster than the cost of living and has become unfordable for millions. Also, the amount of disposable income that the average family keeps after taxes (income, payroll, sales, property, etc.) is far smaller today than it was in 1960. The point here is that when all of these things are factored in, the number of people in “real” poverty is often twice that of the official numbers.[4]

To be fair, the Census Bureau knows this (see their report cited in the notes) but cannot factor these things in until Congress tells them to and don’t hold your breath. Congress has never shown an interest in changing the poverty formula. My guess is that it is because they also will prefer using a lower poverty number over higher ones because it makes us look wealthier as a nation than we really are.

Third, we may be in for some dark and stormy nights for years to come.

If you read closely in the poverty statistics you noticed some scary trends. The most ominous is that from 1998 to 2008, median incomes in America went down from $51,295 to $50,303 for a family of four, and the number of non-farm jobs — roughly 131 million — pretty much flat-lined.[5] That includes the years in the decade when we were going through the “Bush Recovery” and the economy was supposedly booming. The only time when our incomes looked like they were rising was in the last couple of years of the fake money of the housing bubble and not real money. That “growth,” as we now know, was like the pea in the old shell games. The magician keeps shuffling the pea from shell to shell giving the impression that there were many peas and each shell had a pea in it, when in reality there was just one pea moving very, very fast (and getting very tired).

To make this even scarier, here are four trivia questions for you: First, when was the last time that we have gone that long without any perceivable rise in median incomes? The answer is, 1982. Second, when was the last time we had this dramatic an increase in poverty in one year: 1991. Third, when was the last time we had a drop of 5% in employment over a period of just nine months? That was back before World War II. And finally, when was the last time we had more than twenty-seven weeks in a row of rising unemployment? The answer is nobody knows. There has never been that long a run of high unemployment since the Bureau of Labor Statistics has been collecting numbers. And that is what should scare us.

What does all of this mean?

There is a rule of thumb in economics, called “Okun’s Law,” which means roughly that when the Gross Domestic Product (GDP) goes down, jobs go down with it, and when the economy goes up, jobs (eventually) go back up with it. With all of the stimulation and economic growth we’ve had in the last six months, the “law” says that we should have around 8.5 % unemployment today. That, however, was the number we passed on our way up to 10% about four months ago. For some reason that economists can’t quite explain, Okun is letting us down. Something in the economy is broken, maybe fundamentally. Jobs seem to be unhooked from economic growth.

Presidential economic advisor, Larry Summers, back in the eighties when he was a lowly labor economist, wrote an important article analyzing Japan’s economy which had been stagnant for over a decade. He said that there were mysterious occasions when something kept Okun’s law from working and employment became unhooked from the rise and fall of the GDP. He called it “Hysteresis.” It comes from a Greek verb meaning “to lack in something central.” You have seen the word in the New Testament a few times. In Mark 12:44, for example, a widow gives alms out of her “lack” (hysterseos). Paul once said in Philippians that while he wasn’t rich, he didn’t have any real “need” (husteresis).

[A different definition and etiology comes from “path dependence” meaning that the future is dependent upon the path. Once you get started in a path, the harder it is to get out of it.]

When applied to the economy, it means that something is mysteriously missing and things aren’t working the way they should, and because it’s gone, we may never be able to return to “normal” again. Something is broken and may not be fixable. In our situation, the economy is growing but jobs are not. Trying to fix that with the old tools of monetary or fiscal policies may miss the problem because what’s missing is a deeper and more structural shift in the entire way we have functioned as a country. The term was applied to Europe in the eighties, Japan in the nineties, and it may well apply to the U.S. in the 2000s and beyond.[6] If true, it means that the old jobs just aren’t going to come back. When new jobs are created, they are invariably of poorer quality than the old ones, a trend that has no apparent likelihood of changing.

Part of the problem is, of course, inevitable. That is, seven million people lost their jobs and it’s hard to pull back to “normal” after that. People now buy fewer groceries, which means the grocer buys less from distributors, who buy less from the wholesalers, who buy less from the manufacturers. And so on until you get down to the coffee farmer in Ethiopia who can’t sell his beans and he grinds them up for mulch to sprinkle around next year. This is a downward spiral, and cannot be fixed quickly, no matter how much stimulus money is spent, even if most of it actually went to job creation, which in our case it did not.

Imagine income in America as a foot ball field. The median income is the fifty yard line. The left goal posts are the most poor. The right goal posts are the Wall Street oligarchy who rake in two and three hundred million dollars a year. The red line represents what used to be a gradual line of income going upwards. http://www.lcurve.org/ZoomShots/Zoom5.gif

Imagine income in America as a foot ball field. The median income is the fifty yard line. The left goal posts are the most poor. The right goal posts are the Wall Street oligarchy who rake in two and three hundred million dollars a year. The red line represents what used to be a gradual line of income going upwards. http://www.lcurve.org/ZoomShots/Zoom5.gif But another important part is hysteresis, a critical “lack” of something in our economy that has kept us prosperous for generations. One thing increasingly lacking is justice in our politics, power, and income distribution. For at least the last thirty years there has been dramatic income growth for the top and stagnation or decline for all the rest. On average, incomes have declined by 2.5 percent among the bottom fifth of families since the late 1990s, while increasing by 9.1 percent among the top fifth. That is a structural problem and a justice problem and it will not be fixed in our lifetimes because of the enormous influence that the wealthy have over the politicians whose re-election campaigns they fund. It’s hard for a Legislator to believe one way on an issue when his re-election is being paid for by a corporate PAC that believes another.

Inflation adjusted percentage increase in after-tax household income for the top 1% and the four quintiles, between 1979 and 2005 (gains by top 1% are reflected by bottom bar; bottom quintile by top bar).[7]

Inflation adjusted percentage increase in after-tax household income for the top 1% and the four quintiles, between 1979 and 2005 (gains by top 1% are reflected by bottom bar; bottom quintile by top bar).[7]http://upload.wikimedia.org/wikipedia/en/a/a4/Income_gains.jpg

A second place where the concept of hysteresis applies is in what has happened to us with economic globalization. Our historic engines of economic growth are crumbling with the advancement of international trade and nothing so far is taking their place. It is an interesting fact that whenever there has been an increase in trade, the gap between rich and poor has gotten larger with more power concentrating at the top and less at the bottom. In the most recent 25-year run of global trade (starting roughly in the early 1980s), some have become winners but many are losers. That has been true since ancient Israel traded wine for wood with its Phoenician neighbors to the north[8] and it hasn’t changed much today.[9] The spoils of trade flow upwards and with them come power and influence. That disparity will be a blight on democracy and our economic development for many, many years to come.

We are a country that became rich on small farms and big industry. Neither are sustainable any longer and we haven’t invented a new model to take their place. Since the thirties small farms have been getting larger and since the seventies industry is getting smaller. We don’t have the will to pay living wages to factory workers while China has millions of poor and starving people willing to make the same items for a dollar a day. It may very well mean that high paying jobs for middle class America are gone forever—or at least for a generation. Joe Stiglitz, speaking at a conference in Pittsburgh just before the meeting of the G-20 last week said that the American economy needed to expand at a rate of 3.2 percent a year to create more jobs than we are losing, and there was nothing visible on the horizon for many, many years that could make that happen. Something is broken in the economy and nobody knows how to fix it.

As you probably know, the U.S. manufacturing base began moving from the northeast to the south about forty years ago. Then in the mid-nineties, with NAFTA, it moved over the border to Mexico. Then beginning in 1999, when China joined the WTO, it began moving from Mexico to China. And manufacturing will probably continue to grow there for generations more. China is so large and poor and undemocratic that it will take multiple decades before its people are free enough to demand living wages. And when that happens, manufacturing will start searching out other poor countries for production. By then the U.S. will have dismantled its entire manufacturing base and suffered through profound emotional and social changes making the transition. It is unlikely that we will ever be the wealthy country we were just twenty years ago. Now, that may not be bad in terms of global justice and a vision of God’s peaceable realm. The U.S. has had too much wealth and too much power for far too long. And the damage done to the environment to keep us there is unconscionable. However, this kind of rapid re-alignment of power never comes without wrenching pain and hardship for those going through it. And as people of faith we need to gear up for a long, hurting period where our wisdom, compassion, and pastoral skills will be tested. In addition, power never gives up its perch without inflicting pain on those around it on the way down. So, look for continued punitive bitterness and reprisals from the wealthy (and those who identify with them) as they try to maintain their wealth and privilege.

How should people of faith respond to these inevitable hardships? What are the issues that our churches should become involved in to help direct the changes in more humane and environmentally friendly directions? Those well may be the most important questions that churches and faith groups will be asking themselves for the next generation.

P.S.

I’m working on an article right now with some biblical reflections on that. It includes discussions of Jesus on goods and services distribution, the Apostle Paul on the establishment of a functioning regulatory framework for trade, and Moses on derivatives trading. I’ll post a draft of it next week and I would very, very much appreciate your thoughts and comments. It’s half tongue-in-cheek, of course. There’s not much in the Bible that has to do with derivatives or credit default swaps, but I do think there are a few faithful, biblically grounded principles for a progressive response to the long-term poverty prospects that loom out in front of us. And I’d like to draw out a few of them for your comments.

In the meantime, print out this post, write the word “bleak” all over it and go drink a cup of coffee.

Notes:

[1] Carmen DeNavas-Walt, Bernadette D. Proctor, Jessica C. Smith Income, Poverty, and Health Insurance Coverage in the United States: 2008 (U.S. Census Bureau P60-236(RV): September 2009).

[2] Heidi Shierholz, “New 2008 poverty, income data reveal only tip of the recession iceberg” (Washington, DC: Economic Policy Institute, September 10, 2009), http://www.epi.org/publications/entry/income_picture_20090910.

[3] Stephen Lendman, “US Census Bureau Confirms Rising Poverty, Falling Incomes, and Growing Numbers of Uninsured: Wall Street is improving but Main Street is worsening in every way. (The Baltimore News Network/Baltimore Chronicle), September 14, 2009.

[4] Shawn Fremstad, Measuring Poverty and Economic Inclusion: The Current Poverty Measure, the NAS Alternative, and the Case for a Truly New Approach, Washington, DC: Center for Economic and Policy Research, December 2008.

[5] David Leonhardt, “A Decade With No Income Gains” (New York Times, September 10, 2009) http://economix.blogs.nytimes.com/2009/09/10/a-decade-with-no-income-gain; Clive Corcoran, “U.S. Median Income from 1999-2009: No Gain, Much Pain,” Seeking Alpha, September 13, 2009, http://seekingalpha.com/article/161271-u-s-median-income-from-1999-2009-no-gain-much-pain?source=article_lb_articles.

[6] Joshua Cooper Ramo, “Jobless in America: Is Double-Digit Unemployment Here to Stay?” Time Magazine, Friday, Sep. 11, 2009, p. 45.

[7] Source: Aron-Dine, A. & Sherman, A. “New CBO Data Show Income Inequality Continues to Widen: After-tax-income for Top 1 Percent Rose by $146,000 in 2004” (Center for Budget and Policy Priorities: January 23, 2007), p. 2.

[8] Roland de Vaux, Ancient Israel Vol. 2 (New York: McGraw-Hill, 1965), p. 481.

[9] See for example, Mark Weisbrot, Robert Naiman, and Joyce Kim, The Emperor Has No Growth: Declining Economic Growth Rates in the Era of Globalization (Washington, DC, Center for Economic Policy Research, November 27, 2000). Also, Aron-Dine, A. & Sherman, A. op.cit., pp. 2-4.