More on "Who Knew" About the Coming Crash

Financial Regulators Held Secret Meeting With Hedge Fund Short Sellers In 2007

John Carney|Aug. 26, 2009, 8:40 AM|

http://www.businessinsider.com/financial-regulators-held-secret-meeting-with-hedge-fund-short-sellers-in-2007-2009-8

The Evening Standard's Paul Waugh reveals today that G7 finance ministers were warned about the dangers of US subprime loans and shaky banks back in April 2007. Famous hedge-funders Jim Chanos and Paul Singer sounded the alarm but were completely ignored.

From Waugh:

Chanos has now revealed that the pair of them warned of "radioactive" securitisations held by banks - and even named those his firm was shorting. But they were "officially ignored" by the G7 ministers.

Chanos picks up the story (forgive me quoting at length but it's worth it):

"It was the April 07 G7 Finance ministers meeting in Washington. It was a rotating chair and the Germans were rotating the meetings. And at the time if you recall the Germans were quite concerned about hedge funds and private equity as being a future source of problems in the market place.

"And Bob Steel, who was the Under-Secretary to the Treasury, who was fighting these German efforts at the time, felt that it would be helpful if two hedge fund managers came down and address the finance ministers and central bankers on the last day. So I was invited along with Paul Singer, who has gone public now, he was the other manager.

“Paul got up and proceeded to give a tour de force presentation on the coming crack-up in structured finance, how all these structures were very unstable and triple A [the ratings given to the securities] was not going to be triple A..."

The meeting was just five months before the run on Northern Rock and more than a year before Lehman Brothers collapsed.

Chanos and Singer pointed out that HSBC had announced that January that its US sub-prime loans were going bad at 'an alarming rate'.

“So there were some canaries in the coal mine by April 07 and Paul pointed them out,”

"I then segued into my presentation which told the assembled regulators that in fact if Mr Singer was correct and I believed he was, that the problem would not be hedge funds it would be the regulated banks and brokers who were leveraged 30-1, many of which held glowing, toxic radioactive pieces of securitisation which they could never sell.

"The German finance minister who was chairing the meeting thanked me politely and then thanked Paul and said 'so what do you think about Hedge Funds?'“

So despite having received this stark warning, the only response from the politicians was 'yeah, yeah but what about tightening up regulation on you guys?'

Mr Chanos, founder of Kynikos Associates, said that immediately after the presentation, the G7 ministers issued a statement continuing to insist that their economies were strong and made no mention of the warnings. Check out the G7 Communique of the time - you won't find a clearer example of the complacency of world politicians and regulators.

“We were completely and officially ignored,” said Chanos.

Teddy's Letters

Back in the eighties I led a number of delegations to Central America. Usually they were for US church groups. But some were for a human rights organization.

This was during the days when the Reagan Administration was supporting the rebels against the government in Nicaragua and the government against the rebels in El Salvador. Our delegations would talk to human rights organizations, faith groups, government officials, displaced people, etc. and give people in the US a sense of what was really going on down there because the media seemed so baffling about it all.

On one of my early trips a social worker from Ponca City, Oklahoma, recommended that I write Ted Kennedy's office and ask him if he would send along a letter of safe passage, just in case we got in a difficult--that is, dangerous--situation. I hadn't thought about that, but I did write to him and weeks later I got a personal letter from the Senator saying "to whom it may concern" that Stan Duncan was a big deal and was traveling under his guidance and that I should be taken care of and treated with respect in any situation that might come up. It was great.

Every year after that, just before my trip I would write him again and every year dutifully he would compose the same letter. I never met him and he never met me, but we had a funny relationship. I was his pet project, the guy he would write the annual letter for and he always asked how I was doing and how the trips went. I'd always write back saying the trip was fine and all was well, but never much more than that. He was, after all, an icon: Senator Edward Moore Kennedy from Massachusetts, and I was just some kid from Oklahoma who was freelancing trying to save the world and trying to not get killed while doing it.

I didn't need his letters all that often, but every now and then it felt good to have one with me just in case. I would take it out and show to a guard or official when they were getting a little testy or suspicious about our intentions. We were there as a church group, and that should have been safe, but occasionally we traveled into areas we weren't totally certain about. It was important to me to do that so that North Americans could get behind the scenes and look first hand what was really happening, since our tax dollars were paying for much of the carnage across the region. And the governments of many of those countries, especially El Salvador and Guatemala were not fond of our doing that at all.

There was one time, however--it was March, 1988. I was up in the Suchitoto region of northern El Salvador. Which was the center of the rebellion and all gringos, doctors, teachers, development workers and human rights representatives were ordered out. I had been living in El Salvador for about six months at that time, ostensibly doing research on economic development projects, but also still doing human rights documentation, this time with journalists from Australia, Britain, and Scotland. We were interviewing refugees from the villages that had been the scenes of bloody massacres by the Salvadoran military. We got into the region by bus, pickup, foot, and on one occasion hiding under bags of grain on a supply boat going up a river. We were able to get some good interviews, notes, and pictures, and I was very pleased about that, but on the way back government troops stopped our bus and took us in. They confiscated all of our bags (which included all of our documentation) and destroyed everything (including a Bible that had been given to me by my aunt when I graduated from high school). And they kept all of us in jail for three days. I don't know about the others--we were kept in different quarters--but I was terrified. The military guards working with me did not treat me badly, but they grilled me day after day about why I was there and what I was doing and who I worked for. I couldn't just say that I was there documenting their own human rights abuses, so I continued my line about doing economic development research.

That wasn't totally untrue. There were a number of re-population villages in the area that I had in fact been looking at--those were villages made up of people who had fled into Honduras from the fighting in El Salvador and were now coming back and "re-populating" new villages. They were a form of economic development model and I claimed I was there to study them. But they didn't quite believe it (and with good reason).

Finally after my third day there someone came to see me who could speak English. I think he had just arrived at the compound because I had not seen him before. He asked me all of the same questions all over again with an increasingly impatient, angry, ominous tone. This time, since he probably could read, I hauled out Teddy Kennedy's letter. He looked at it silently for a long time (I remember wondering if he was having trouble with some of the words). Then when he got to the end he grew even more angry. He tore it in half and threw it to the ground saying that this was nothing, it means nothing, it was irrelevant to their questing, and they still needed to know the truth about why I was there or I would never go home.

He turned and walked out of the room and left me alone. I picked up the pieces of the letter, folded them up, put them back into my back pack, and started to sit down, but before I could do that the door came open again and the guards that I had been interrogated by for the last two days came in and escorted me out of the compound and, without saying a word, pushed me into the street. I was free. Moments later, while I was still standing there trying to understand what had happened, my friends were pushed out the same door and there we all were.

We were exhilarated about being out and alive and through the ordeal. We jumped up and down screaming and laughing and decided to celebrate by going to a local bar and having a beer.

But unfortunately I never thought much about the letter after that. I've told this story a number of times to all of my friends, but one person I never told it to was Ted Kennedy. I have never written him to thank him for saving our lives.

It's true that he may not have. It's possible that we would eventually have been set free, after all back in those days the worst thing that the Salvadoran government wanted to be known for was killing off a citizen of the country that was giving it one million dollars a day in aid.

On the other hand, you never know. Our situation looked pretty grim for a while and who knows how many days would have gone by? Each day the guards were growing angrier and angrier at us and at our stone wall of silence about why we were there and what we were really up to.

There's a real chance that none of us would have made it home alive had it not been for that yearly letter that Kennedy sent with me, saying (incredulously) that I was an important somebody and that I was to be taken care of and treated with respect, with the implied threat that if I was not, then there would have hell to pay from the Kennedy office.

I never thanked him. I never saw him. I never called up or wrote or dropped by, and never told him that I might not be alive today had it not been for his help. After that trip I came back to the United State and moved to Boston and became a student again at Harvard. I started a new life and a new career and never remembered to express the gratitude I owed him for his help. And now I can't.

Except that in an improbable, unlikely, and slightly impossible way, it is just slightly possible that the big ball of life and fire and laughter and compassion and humor and drive and strength that he was for so many years might still be with us in another way and in another realm. Who knows? And if that is so, and if he is perhaps mysteriously or spiritually or cosmically listening in, then perhaps it is time to finally say thanks.

I never did that when you were alive, Teddy. I never thought about it until you were no longer alive. But the truth is, I may well be one of the hundreds of thousands of people across the country and the world whom you helped over the years in simple and easy, and sometimes heavy and profound ways. I wish I had said it earlier, but at least I'm saying it now. I might not be able to be here writing this had it not been for you.

Thank you.

The Public Option's Last Stand, and the Public's

Robert Reich

Reprinted from his Blog, Aug 16, 2009

I would have preferred a single payer system like Medicare, but became convinced earlier this year that a public, Medicare-like optional plan was just about as much as was politically possible. Now the White House is stepping back even from the public option, with the President saying it's "not the entirety of health care reform," the White House spokesman saying the President could be "satisfied" without it, and Health and Human Services Secretary Kathleen Sebelius saying that a public insurance plan is "not the essential element."

Without a public, Medicare-like option, health care reform is a bandaid for a system in critical condition. There's no way to push private insurers to become more efficient and provide better value to Americans without being forced to compete with a public option. And there's no way to get overall health-care costs down without a public option that has the authority and scale to negotiate lower costs with pharmaceutical companies, doctors, hospitals, and other providers -- thereby opening the way for private insurers to do the same.

It's been clear from the start that the private insurers and other parts of the medical-industrial complex have hated the idea of the public option, for precisely these reasons. A public option would cut deeply into their current profits. That's why they've been willing to spend a fortune on lobbyists, threaten and intimidate legislators and ordinary Americans, and even rattle Obama's cage to the point where the Administration is about to give up on it.

The White House wonders why there hasn't been more support for universal health care coming from progressives, grass-roots Democrats, and Independents. I'll tell you why. It's because the White House has never made an explicit commitment to a public option.

Senator Kent Conrad's ersatz public option -- his regional "cooperatives" -- won't have the scale or authority to do what a public option would do. That's why some Republicans say they could buy it. What's Conrad's response? "The fact of the matter is there are not the votes in the United States Senate for a public option. There never have been," he tells "FOX News Sunday." Conrad is wrong. If Obama tells Senate Democrats he will not sign a healthcare reform bill without a public option, there will be enough votes in the United States Senate for a public option.

I urge you to make it absolutely clear to everyone you know, everyone who cares about universal health care and what it will mean to our country, that the bill must contain a real public option. Tell that to your representatives in Congress. Tell that to the White House. If you are receiving piles of emails from the Obama email system asking you to click in favor of health care, do not do so unless or until you know it has a clear public option. Do not send money unless or until the White House makes clear its support for a public option.

This isn't just Obama's test. It's our test.Who Knew?

Here's a joke that economists used to tell at conventions, that is, until 2008 when it stopped being funny:

Once upon a time two people were walking along the beach. One looks up and sees an enormous cloud gathering on the horizon. He says, “Hmmm, that looks a lot like a hurricane. Perhaps we should take cover.”

The other says, “Naw, it can’t be. If it was a real hurricane, the sun bathers on the beach would be running and hiding, and nobody’s doing that. Nobody’s acting worried. Therefore it can’t be a hurricane if people aren't acting scared. At worst it’s a mere rain storm.”

Moments later the beach, the bathers, and both walkers were all washed away by the hurricane.

A few months ago Dick Cheney was being interviews on PBS’s The News Hour by Jim Lehrer, and Lehrer asked him why he didn’t see the financial meltdown coming. Cheney responded that “nobody” saw it coming. “Nobody” could have known that this was about to happen. Then he turned to Lehrer and said, “Did you? Did you see it coming?” The truth was, Jim Lehrer did see it coming. He had had numerous people on his show for years reporting that an unnatural bubble in housing and finance was growing out of control and that it would have to eventually pop and would do so with great damage to the economy. But instead of saying that, he politely deflected the question back to Cheney saying, “Well, you’re the Vice President. You are supposed to see these things on the horizon and make plans for them.”

If it had been me, of course, I would have said something like, “Damn straight Mr. Vice President! And I can give you a truckload of names of people who tried to warn you. So, why the hell were you, and that Bush guy who worked for you, so asleep at the wheel?” But then, that’s one of the reasons why Jim is on the air and I’m not.

In actual fact there were a large number of people who saw what was happening and were alarmed about it. In this note I’m going to offer you a laundry list of notables. This isn't something you need to read to the end, but think of it as a resource. You might want to keep the list close to hand so that if one of these people shows up on TV, you will know to pay close attention to what they say.

And also, you never know. One of these days you might be walking down the street and run into Dick Chaney and he might turn to you and say “could anybody have known?” and you can haul out your list and say, "Hell yes. These guys did."

After you've read through the list, I have two questions for discussion. Write me a note if you have an answer (you'll be graded on this):

First, why is it that not one person on this list is from the far right politically? They are all from the moderate left to the far left. What is it about the hermeneutical ideology of progressives that they had the eyes to see and the ears to see what we were doing to ourselves?

And second, an even more interesting question: why is it that not one of these very smart perceptive people, who saw the crash coming, and tried in vain to warn the powers that be about the dangers of it, are employed today in the Obama administration? Instead of calling upon the wisdom of the people who saw the brewing fiasco and called it, why has Obama only hired foxes to clean up the hen house?

Blessings on you all. Here is the list.

Stan

Here's a relevant quote from his book:

"The financial ecology is swelling into gigantic, incestuous, bureaucratic banks -- when one fails, they all fall. The increased concentration among banks seems to have the effect of making financial crises less likely, but when they happen they are more global in scale and hit us very hard... I shiver at the thought."

b. Paul Krugman. A Nobel Prize winning progressive economist who teaches at MIT and writes for the New York Times. Among other times, in 2005 he wrote

"The U.S. economy is currently suffering from twin imbalances. On one side, domestic spending is swollen by the housing bubble, which has led both to a huge surge in construction and to high consumer spending, as people extract equity from their homes. On the other side, we have a huge trade deficit, which we cover by selling bonds to foreigners. As I like to say, these days Americans make a living by selling each other houses, paid for with money borrowed from China. One way or another, the economy will eventually eliminate both imbalances."[1]

c. Dean Baker. Co-director of the Center for Economic and Policy Research. He has written numerous warnings about the dangers of a housing bubble and the dangers of it bursting, too many times to mention. In 2004, he got so convinced that there was a growing burstable bubble that he sponsored a $1,000 essay contest to see who could write the best argument for why there was not a bubble. The winner’s essay was posted on his web page along with his rebuttal.[2]

Here is a quote from an article in The Nation magazine in 2004:

“At the end of the day, housing can be viewed like Internet stocks on the NASDAQ. A run-up in prices eventually attracts more supply. This takes the form of IPOs on the NASDAQ, and new homes in the housing market. Eventually, there are not enough people to sustain demand, and prices plunge.

The crash of the housing market will not be pretty. It is virtually certain to lead to a second dip to the recession. Even worse, millions of families will see the bulk of their savings disappear as homes in some of the bubble areas lose 30 percent, or more, of their value. Foreclosures, which are already at near record highs, will almost certainly soar to new peaks.[3]

In his column December 15, 2008, he said that Wall Street and the Federal Reserve and the Wall Street Journal and the Washington Post, etc, did not want to hear from people who were bearing bad news about the upcoming train wreck.

“One of the key lessons of this economic crisis should be that there is a remarkable lack of capacity for independent thinking in our most important institutions: government (both the executive and legislative branches), business, the media, and academia. It is possible that an important authority figure could force a re-examination of deeply held views of the world, but we all must recognize that there is a huge amount of dogma to overcome.”

Here’s a link to a 2007 New York Times article about people who saw the crisis coming that focusses mainly on Baker, called “They Cried Wolf. They Were Right.”

d. Robert Kuttner. Editor of The American Prospect, and columnist for the Boston Globe. He wrote a really fine article a couple of years ago in The American Prospect called, “The Bubble Economy.”[4] In it he discussed what he called “the sub prime mess,” what caused it (mainly focusing on a history of deregulation) and where it would take us (a depression). Bob’s a bright guy, but he’s no genius. How come he could see all of that coming and Alan Greenspan said the burst blindsided him?

e. Doris Dengley. I know least about her, except that she is credited as smelling something fishy in the arcane, obtuse, obscurant, Byzantine, financial pages of corporations and wrote about the inherent dangers in them on her blog, “Calculated Risk,” and that she tragically died about a year ago before her prophesies came true.[5]

f. Joseph Stiglitz. Former president of Clinton's panel of economic advisors, chief economist at the World Bank, and Nobel Prize winner in economics. Now teaches at Columbia. He has not been a crusader against the bubble, but has written about it and its potential damage for a long time. Here's a quote from a journal article he wrote for the Economist's Voice. The most telling part of it is the title, "It Doesn't Take Nostradamus."[6]

"I warned roughly two decades ago of the need for greater government regulation of mortgage securitization. I don't think my prediction showed any astounding brilliance. Others no doubt felt similarly. Economic theory--and historical experience--made the risks apparent. Unfortunately, the call for the regulation of mortgage securitization reached deaf ears at that time. Let's hope that this time is different. The next crisis may well be different than the present one, but I'd like to see appropriate regulations that make sure of it. "

g. Robert Shiller. Professor of economics at Yale. Famous today for predicting both the Dot.com bubble burst of the late 1990s and now the housing and finance bubble of 2007. He did it by tracking housing values (adjusted for inflation) from 1900 on, and finding that prices were remarkably stable—at least until the late 1990s, and they exploded in the 2000s. In the past, every time--emphasize every--time they have gone up, they have eventually come down. This boom would be no exception, he said, and as soon as that happens there will be economic shrapnel all over the American economic landscape.

Here’s a link to a great article about Shiller in 2005 in which he correctly forecasts a recession and a drop in housing prices of forty percent. “Be Warned: Mr. Bubble's Worried Again.”

Relevant quote:

"This is the biggest boom we've ever had," said Mr. Shiller…"So a very plausible scenario is that home-price increases continue for a couple more years, and then we might have a recession and they continue down into negative territory and languish for a decade.

"It doesn't even attract that much attention," he continued. "…even though [by then] prices may have gone down in real terms by 40 percent."

He was right.

Here are some pieces of an interview with him in 2007 on CNN about the bursting of the bubble just before it happened. It can be found here: “Shiller: Mr. Worst-case scenario”[7]

"[T]his is the biggest boom in housing prices since, well, ever. Nothing seems to explain it, and nobody forecast it. It seems to me…human thinking is built around stories, and the story that has sustained the housing boom is that homes are like stocks. Buy one anywhere and it’ll go up. It’s the easiest way to get rich.

From 1890 through 1990, the return on residential real estate was just about zero after inflation. Since 1987 it’s been 6 percent [or about 3 percent a year after inflation]. [but in the last ten years real estate has risen by about 10 percent a year.] It can’t be true that homes rise 10 percent a year. If they did, in the long run no one would be able to afford a house. (In 2005 they went up 14 percent.)

[A $25,000 home in 1957 should be worth roughly $3 million now.] And that flies in the face of common sense. In fact, I’m inclined to think there’s a good chance that the return on real estate will be negative, substantially negative, over the next 10 years because all booms reverse in the end.

Today (July, 2007:…Avoid concentration of risks. You need a house, but I would avoid a second one - or at least avoid an outsize house. Over-investing in real estate now would be a recipe for disaster.

h. William Brennan. A little more than a decade ago, he foresaw the financial collapse of 2008 coming and tried to warn people, but to no avail. As director of the Home Defense Program at the Atlanta Legal Aid Society, he watched as subprime lenders earned enormous profits making mortgages to people who clearly couldn’t afford them. The loans were bad for borrowers — Brennan's experience in working with struggling new home buyers told him that knew that. But he could also see that the loans were eventually going to be bad for all the Wall Street investors who were buying up these shaky mortgages by the thousands. And he spoke up about his fears.

Relevant Quote from his testimony before the Senate Special Committee on Aging in 1998:

“I think this house of cards may tumble some day, and it will mean great losses for the investors who own stock in those companies.”

i. Nouriel Roubini. Professor of international Economics at NYU. Iranian Jew, born in Turkey. Past senior economist for the Council of Economic Advisers for Bill Clinton. As far back as 2005, Roubini was saying that home prices were riding a gigantic speculative wave and that they would soon slide downward and sink the economy. At the same time that Federal Reserve chair, Ben Bernanke was testifying in Congress about how the real-estate problem was "contained," Roubini, bless his heart, was publishing a paper that said that the depressed housing market was nowhere near its bottom and that its contraction would be the worst in decades. His was a very grim prognosis, and was laughed at and called a "Cassandra." The New York Times belittled him by calling him "Dr. Doom." Because he had the brains to look at reality and say it looks like reality, today he’s considered a sage.

Relevant quotes:

Fall 2007: "The FDIC spent 10% of its reserves to bail out IndyMac, and that was the first in a wave of failures. Will we soon have to bail out the FDIC?"

September 2006, in a report to the IMF: "The United States was likely to face a once-in-a-lifetime housing bust, an oil shock, sharply declining consumer confidence, and, ultimately, a deep recession."

For the best recent article on him, see James Fallows, "Dr. Doom Has Some Good News," the Atlantic, July/August 2009.[8]

J. Brooksley Born. Now retired, but during the 1990s, she was the chair of the Commodity Futures Trading Commission (CFTC). She is notable on this list because she tried unsuccessfully to bring over-the-counter financial derivatives under the regulatory control of the CFTC. The government’s failure to regulate such financial deals has been widely criticized as one of the causes of the current financial crisis. In the booming economic climate of the 1990’s, Born battled other regulators in the Clinton Administration, skeptical members of Congress, and lobbyists over the regulation of derivatives. Her argument was that unregulated financial contracts (such as the evil "credit default swaps") could wreck the entire economy. For her efforts to save the world she was vilified by everyone from Wall Street to the Clinton Administration, all of whom who believed deregulation was wonderful and peaceful and kind and a cure all for all economic ills.

A relevant quote from her acceptance speech for receiving the 2009 Profile in Courage Award [9]:

When I spoke out a decade ago about the dangers posed by the rapidly growing and unregulated over-the-counter derivatives market, I did not do so in expectation of award or praise. On the contrary, I was aware that powerful interests in the financial community were opposed to any examination of that market. Yet I spoke out because I felt a duty to let the public, the Congress and the other finan-cial regulators know that that market endangered our financial stability and to make every effort I could to address that problem.

K. Sheila Bair. Head of the Federal Deposit Insurance Corporation. She, like Born, tried hard to sound the alarm within the system, but was resisted and ignored. A good history of her work is found in the words of Caroline Kennedy when she was bestowing (along with Brooksley Born) the 2009 "Profile in Courage" award.

"As early as 2001, then working in the Treasury Department, she saw the potential for abuse in the sub-prime lending business, and urged the industry to adopt a set of best practices to minimize risks to the economy. In 2003, she called for serious reform of the federal regulatory system, arguing that existing policy was insufficient to protect the economy and the public from the risks associated with an increasingly complex and rapidly growing financial industry.

As FDIC Chairman at the height of the bull market in 2007, she again recognized the economic threat posed by subprime loans, and the danger of unchecked greed and negligence by well-connected interests. She proposed that subprime mortgage rates be permanently fixed before they ballooned and forced hundreds of thousands of homeowners into foreclosure. Last July, she halted all foreclosures on loans owned by IndyMac Bank following its failure. And she urged that mortgage relief for distressed homeowners be part of the economic rescue plan of 2008.

She stood up for average, taxpaying Americans, and held her ground under intense criticism from political adversaries. Her efforts to include borrowers in the financial rescue plan met with fierce opposition from other officials in the Bush Administration, who blocked her efforts even as the housing crisis and the economy worsened.[10]

A relevant quote (from her acceptance speech)"

I am very direct. My family tells me that I'm too direct. I wanted to make sure our policies helped the average homeowner on Main Street," said Bair. "We could see the train wreck coming."[11]

---------------------------------------------

Notes

[1] These quotes can be found here: http://www.huffingtonpost.com/arianna-huffington/rewarding-those-who-got-i_b_149388.html. Also see, Paul Krugman, "Lest We Forget," New York Times, November 27, 2008, on why people should have seen it coming, http://www.nytimes.com/2008/11/28/opinion/28krugman.html?_r=2&emc=tnt&tntemail0=y

[2] http://www.bankrate.com/brm/news/mortgages/BakerFamily.asp

[3] Article found here: http://www.thenation.com/doc/20040816/baker Similar others found here: http://www.truthout.org/article/dean-baker-after-housing-bubble-bursts or here: http://www.cepr.net/index.php/op-eds-columns/op-eds-columns/the-housing-bubble-a-time-bomb-in-low-income-communities/ Or here: http://www.cepr.net/index.php/op-eds-columns/op-eds-columns/building-on-the-bubble/. Also see articles in bankrate.com about him here http://www.bankrate.com/brm/news/mortgages/20040422a1.asp.

[4] Robert Kuttner, “The Bubble Economy,” The American Prospect, September 24, 2007. http://www.prospect.org/cs/articles?article=the_bubble_economy

[5] See her long article in 2006 about Citi-Bank at http://calculatedrisk.blogspot.com/2006/12/tanta-let-slip-dogs-of-hell.html

[6] Stiglitz, Joseph E. (2008) "It Doesn't Take Nostradamus," The Economists' Voice: Vol. 5 : Iss. 8, Article 1. Vol. 5 (2008) / Issue 8 / Columns. (http://www.bepress.com/ev/vol5/iss8/art1)

[7] Jason Zweig, “Shiller: Mr. Worst-case scenario” Money Magazine; CNN/Money.com, July 6 2007)

[8]You can also find it online here. http://www.theatlantic.com/doc/200907/roubini

[9] http://www.jfklibrary.org/Education+and+Public+Programs/Profile+in+Courage+Award/Award+Recipients/Brooksley+Born/Acceptance+Speech+by+Brooksley+Born.htm

[10] http://www.jfklibrary.org/Education+and+Public+Programs/Profile+in+Courage+Award/Award+Recipients/Sheila+Bair/Remarks+by+Caroline+Kennedy.htm

[11]http://www.videosurf.com/video/sheila-bair-honored-with-jfk-profile-in-courage-award-66683207

The Birthers and Jim Crow 2.0

By: Kai Wright

From TheRoot.com

The manufactured anger driving the birthers and health care town halls is the same white rage that has divided poor white people from poor black people for all of our history.If ever there was a “teachable moment” about race in modern America, now is it. With the birthers and the reparations conspiracy theories and the Nazi imagery at health care meetings, someone’s gotta explain why all these white folks are wilding out. We need an articulate, impassioned race man to clarify things. But not Al Sharpton; I say pass the mic to Jim Webb.

Remember way back when Webb, a Democratic senator from Virginia and the voice of Appalachia’s neglected white yeoman, was sniffing around a veep nod? In the midst of that media moment, he hit on an idea we’d do well to dwell upon. “Black America and Scots-Irish America are like tortured siblings,” Webb patiently explained to Pat Buchanan in a May 2008 Morning Joe appearance on MSNBC. “There’s a saying in the Appalachian mountains. … ‘If you're poor and white, you’re out of sight.’”

Webb went from there into a bizarre attack on all the nonwhite and nonblack people who he believes have hijacked affirmative action. But his core message is deeply relevant to today’s tumult. Poor whites have always gotten screwed in America, Webb told us, and they’re terribly angry about it. Whoever directs that rage harnesses a powerful political tool.

Which brings us to both the profiteering right-wing media and the aimless Republican Party stuck in its tail wind. Both have decided their survival in America’s new multiracial reality depends upon a very old playbook: pursue narrow financial and political gain by exploiting the justified anxieties of working-class whites.

As a result, we all feel like we’re living through a Saturday Night Live skit. Each day brings another twisted punch line. More than half of Republicans aren’t convinced Obama’s a citizen? Huh? Fox host Glenn Beck actually attracts viewers by proclaiming Obama has “a deep-seated hatred of whites”? Health reform as Holocaust? Really?

Most commentators try to make sense of it by harking back to Nixon and the GOP’s “Southern strategy,” when it consolidated regional power by stoking reactionary fear of the civil rights movement. That’s true as far as it goes. But years earlier Martin Luther King described it more broadly. “The Southern aristocracy took the world and gave the poor white man Jim Crow,” he explained, summing up the region’s history in a sentence. “And when his wrinkled stomach cried out for the food that his empty pockets could not provide, he ate Jim Crow, a psychological bird that told him that no matter how bad off he was, at least he was a white man, better than a black man.”

The white aristocracy is still serving that gamy old bird. All that’s changed is the waiter. Gone are thugs like Bull Conner and the local elites whose power they protected. In are stooges like Beck and the corporate media elites they enrich. Rupert Murdoch may have decided that the feud between his guy Bill O’Reilly and MSNBC’s Keith Olbermann hurts News Corp.’s bottom line, but you’ll see no such restriction on demagoguery. And Rush Limbaugh brags that 2009 revenue is “through the roof.”

These loud-mouthed robber barons bedevil national Republicans. But the party knows the fear and anger they stoke is nonetheless as useful as ever in the heat of battle, because convincing poor whites to hurt themselves remains a powerful tool for blocking reform. The ugly mobs of GOP operatives-turned-grass-roots activists at this summer’s town hall meetings are only incidentally fighting health care reform. Their real purpose is to show how frustrated whites can direct their anger at Democrats. Feeling poor, white and out of sight? It’s because that black guy’s trying to reshape America without you. Get him!

Fox’s Glenn Beck said it best: “Everything that is getting pushed through Congress, including this health care bill, are transforming America, and they’re all driven by President Obama’s thinking on one idea: reparations.” And Limbaugh, back in November: “The objective is an expanding welfare state. And the objective is to take the nation’s wealth and return to it to the nation’s quote, ‘rightful owners.’ Think reparations. Think forced reparations.” (Your lips to God’s ears, Rush.)

That sounds absurd, but it’s a heck of a lot easier to assert than, say, explaining that a small, white aristocracy has spent centuries robbing America, poor whites included. Slavery made a tiny sliver of Southern whites extremely wealthy, while preventing most from making a living. Reconstruction floundered, at least in part, because lawmakers freaked out when white laborers started talking about getting rights, too. A century later, during the Bush years, worker productivity shot up 20 percent, the wealthiest 400 Americans became $670 billion wealthier—and median wages fell.

Webb wants Democrats to finally free the poor white mind from the grip of its self-defeating fear. “If this cultural group could get at the same table with black America, you could rechange populist American politics,” he told Morning Joe viewers. “Because they have so much in common in terms of what they need out of government.”

Webb wasn’t the first to make the point, but he’s been the only one to get away with it. In the 2004 primary, Howard Dean got maligned by fellow Dems for saying it; Obama tried and failed to make the point during the great “bitter” debate of 2008. The anxieties of poor whites have become the third rail of Democratic politics.

But Democrats cannot avoid the conversation. Indeed, poor white anxiety will only grow as the nation becomes ever more demonstrably multiracial. Either profiteering white elites like Limbaugh will whip them into violence, or someone will finally figure out how to build the populist coalition of Webb’s dreams.

http://www.theroot.com/views/birthers-and-jim-crow-20

The Economic Meltdown and the Third World

Years ago I was drinking sangrias at a cock fight outside of Cuernavaca, Mexico, with a guy who had just gotten fired from the Mexican finance ministry (long story, don’t ask).

Among other things we talked about (like why did you take me to a cock fight?) also asked him why he got fired. He said something like, “The US is in a financial crisis, and whenever your economy stumbles, ours collapses. You are like a giant water buffalo and we are the little animals that live in its coat. When you are healthy, we are fine. But if you fall over, or run stupidly into a fire, you get hurt, but we burn up. We are your needed, but unwanted bastard step-child.”

That was a long time ago and the financial crisis passed and now we are in another one. But our conversation has been haunting me as our nation is once again mired in the worst financial briar patch in generations. I wonder how my friend is doing these days?

During the fake money boom years of the

The second thing is trade. Developing countries are like export platforms to places like the

The third thing is remittances, Those are the extra money that immigrants send home after cleaning toilets in

As if we didn’t need any evidence, a recent study put out by the British Institute for Development Studies[4] showed that underclasses in poor countries are eating less often, pulling their children out of schools to work the fields, and families are being broken up as husbands are forced to leave home looking for work. Remember too, that in addition to the present crisis, last year’s oil price spike and multi-national crop failure and creeping climate change, had already begun causing human destruction throughout the third world like a modern black plague.

So, what can you and I do about it? Well, the short answer is not much. On a macro level, even if the wealthy countries stepped up to the plate and spent the paltry $20 billion they promised in April to help the developing world (which they won’t) it still wouldn’t make up for the amount that has been lost by the decline in remittances. And if you and I gave more money to Church World Service (which we should), cumulatively it would help only a fraction of the people who have lost their homes to the global destruction.

What it would take in the long run would be a complete re-drawing of the global economic map. The financial crisis that we are going through is terrible, but it is a bi-product of a much deeper economic structural problem that until addressed will continue to force these wild and painful bi-polar economic mood swings onto the world forever.

Things like an international regulatory agency with enforcement powers which could reign in the banks who make dangerous obsessive compulsive bets with other peoples’ money. And do it with impunity because they know that they will always be bailed out by rich country governments if they bet the farm and lose everything.

Re-writing of global trade rules that are now subtly (and sometimes not so subtly) biased towards the countries with the most money (remember the Golden Rule: Those who have the gold get to make the rules). And an end to policies that force poor countries to continually over produce, which is good for us because we can buy things for less money, but bad for them because they have to sell things for less money.

Dismantling (and in some cases arresting) the oligarchies who have ruled both rich and poor countries (starting with our own) since at least the beginning of the modern age of globalization (which I put at August, 1982, but that’s for another time).

And a few others.[5]

What small things can you do? Well, we’re not helpless. Don’t do nothing because you can’t do much. For one thing, if you have a job you really ought to be giving more money to Church World Service, or Oxfam or another fine development organization. It can’t save the world, but it can save a family, and that’s a start. Click here for Church World Service.

For another, there are several bills in Congress right now that are a down payment on a new international economic order and you can write your senators and representatives in support of them.

For example, Bread for the World, the Christian hunger and poverty lobby is sponsoring a bill that would completely overhaul and make more effective the way the

Second, JubileeUSA, known best for its relentless campaign to lift the crippling debts that have been drowning most of the developing world for thirty years, is still alive and involved in a number of important campaigns for better financial structure and terms of trade around the world. A good example is their “Vulture Fund” campaign. Vulture funds are the insidious, immoral companies that buy the defaulted debt of poor countries from the original lender, often for pennies on the dollar. Then they wait until a country receives debt cancellation from governments or international financial institutions and then sue in US or European courts to seize the newly available resources and make the poor country pay top dollar. It seems impossible to do, but they are doing it and they should be stopped. There is a bill in Congress about it now. Click here to go to their web page and get more information.

Interestingly, both Bread and Jubilee host a special Sunday for churches each year to highlight their issues in a worship setting. This year, by total coincidence, they have fallen on the same Sunday, October 18. This is a tremendous opportunity for you to lift up the global economic crisis and our churches’ response to it. Both organizations offer sermon notes, worship ideas, and Bible studies that can help you. Put the two together and celebrate the possibility of making a contribution to lightening the darkness of this global crisis. It would be a great way to educate and motivate your congregations on how to be a part of the global community.

Bread for the World Sunday

Jubilee Sabbath resources

When my banker friend down in

He laughed. “It’s you,” he said.

“What do you mean?” I said. “I’m just sitting here.”

“Seems like every time we’re around you Americans,” he said, “we start going off in the wrong direction. I think you are a bad influence on us.” He was kidding, but he also made a point.

Maybe someday—probably not soon, but some day—there will be a time when none of our children are step-children, all of us are in the same family, and all of us will be going in the same direction. It’s a possibility, it's worth a shot, and it’s worth a prayer.

Foreclosures: The Problem That Won’t Go Away

By James Kwak|Aug 7, 2009, 2:19 PM|Author's Website

With everyone hoping for positive GDP growth in Q3 and Goldman Sachs analyst Jan Hatzius now predicting growth at an annual rate of three percent in the second half of the year, the banks, investors, and politicians are all hoping that that nasty problem of foreclosures would just go away already. Unfortunately for everyone – especially the people losing their houses – there’s no reason for it to go away.

Unemployment is always a lagging indicator, and given the record low number of average hours worked, it will turn around especially slowly this time. Until then, people will continue to lose their jobs and wages will remain flat, and any small rebound in housing prices is unlikely to help more than a few people refinance their way out of unaffordable mortgages. So unless the other part of the equation – monthly payments – changes, the number of foreclosures should just continue to rise.

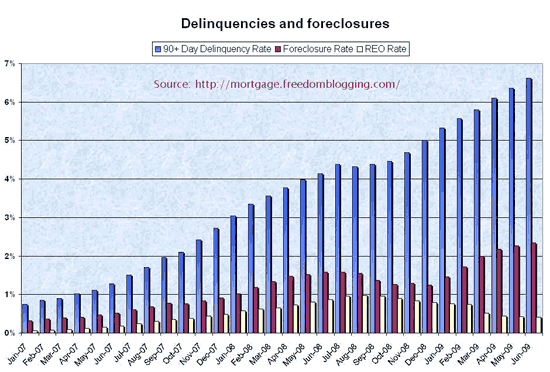

Calculated Risk provides this great chart from Matt Padilla (see the CR post for definitions of the categories):

The foreclosure problem has gotten a little more press recently as the Treasury Department attempts to follow through on its “name and shame” campaign to pressure mortgage servicers to modify more loans.

There seem to be two main explanations for why more loans are not being modifyied. The New York Times recently reported that for the servicers at the center of the process, it is simply more profitable to make fees off of delinquent loans than to foreclose on them and give up that stream of fees. On this theory, the cash incentives being provided by the government are simply not big enough to change their financial incentives.

The servicers prefer to argue that their hands are tied by the investors who own the mortgage-backed securities that have swallowed up the mortgages. On this theory, the Pooling and Servicing Agreements that govern these securitization trusts restrict the ability of servicers to modify mortgages. However, an article by Karen Weise in ProPublica yesterday casts serious doubt on this claim. Weise follows a household that is trying to get a modification of their mortgage, serviced by Wells Fargo, under the Making Home Affordable plan. Wells Fargo (NYSE:WFC) claims that it cannot modify the mortgage under those terms because “the investors need their money,” and instead proposed a different modification, which would increase the loan principal by $80,000. However:

researchers at UC Berkeley’s law school looked at the contracts covering three-quarters of the subprime loans that were securitized in 2006. The researchers found that only 8 percent prohibited modifications outright. About a third of the loans were in contracts that said nothing about modification, and the rest set some limits but generally gave the servicers a lot to leeway to modify, particularly for homeowners that had defaulted or would likely default soon.

And that is the case with the loan in question, for which the servicer need only make a “reasonable and prudent determination” that the modification is in the investors’ interests. What’s more, in this case, “Deutsche Bank [trustee for the securitization trust] spokesman John Gallagher said servicers are ’solely responsible’ for deciding all modifications.”

According to Weise’s article, the administration anticipated servicers’ fear of being sued by investors, but a key phrase in the proposed legislation was removed by Congress as a result of lobbying efforts. Servicers would probably have preferred the phrase be left in, but the end result is it gives them a convenient excuse for failing to modify mortgages – which, as the Times pointed out, is often in their own financial interests.

It will be interesting to see if the administration chooses to take serious action to reduce foreclosures, or whether it sticks to a “name and shame” strategy that is likely to be ineffective.

Well, At Least Wall Street is Having a Good Time

There’s an odd thing happening on Wall Street, and it doesn’t look good.

Overall since January, most companies on the stock market have gone up in by about 20 percent while their earnings have gone down by about 29 percent. That’s an odd thing to happen. Normally, if a company is losing money, investors will bid the price of its stock downward because it means they were getting less money to send home to the shareholders. In today’s dismal environment, however, investors were bidding the stock up because they had been expecting companies on Wall Street to be much worse.

And it’s no wonder. These days, making up for past sins when Wall Street analysts would say that any company with a pulse was a Titan, they have been projecting nothing but doom and gloom. Here’s the best description of the economy that I’ve heard, in the words of Tatyana Shumsky, “The economy is in free fall, the Fed funds rate is effectively zero, unemployment is heading to ten percent, and the Antichrist is coming to get your puppy.”[1]

But today, analysts seem ecstatic that the companies on the S&P 500 are alive at all. The Dow Jones Industrial Average has in fact been rising for the last quarter and was up in the 9000s for most of the last week. This, of course, has little to do with whether or not the companies are making any new widgets and a lot to do with the fact that investors are pleased that the companies are simply doing better than expected. It’s like seeing an old friend and saying, “hey you look wonderful, I thought you were dead.”

That’s fine, but the part that bothers me is that their “better than expected earnings” are not the result of making and selling anything, but because they have been offshoring jobs and firing a truck load of people and thus have lowered their costs. Their profits are up because their employees are down. That makes them look good on paper and their earnings-per-share numbers come in above the analysts’ projections, but it also means your brother-in-law is still living in your garage (to quote myself from a previous post). The model seems to be that if a company fires enough people, it gets to keep a lot of money in its pocket (and watch its stock go up), even if its sales are bupkes, and Wall Street is happy. Bob Herbert, writing in the New York Times on this said, “That’s not recovery, that’s mumbo jumbo.”[2] I couldn’t have said it any better.

There are two problems with this. First, obviously, if they keep using this technique to raise profits, eventually there will be nothing left but wealthy stock holders and a home office in the

Commenting on this phenomenon, Robert Reich says that “If investors begin putting more money into the market, then the market will automatically rise, leading more investors to put in more money — until, that is, the rally ends because nothing has fundamentally changed in the real economy.”[3] And we’re back to bubbles and the glories of 2007. I can’t wait.

Meanwhile, the message is to try not to focus on the cheerleaders on CNBC, Wall Street Journal, or the Fox Business Network. Look instead at jobs, food, people, and the environment: that is, the places where a real economy lives. If the bottom is doing well, the top will do just fine. It’s the trickle up theory and I think Jesus said it first.

From the "Just when you thought it was safe to go back in the water" department

One more thing. Most of the horrors of last fall revolved around the horrific number of subprime mortgages that people could no longer pay on, which dried up the money going to Wall Street, which dried up money to your IRA, and your local bank, and which then threatened to end life on earth as we know it (and the Anti-Christ was coming to get your puppy). After about five trillion dollars were invented out of nowhere to bail them out, most of us came to believe that at least that crisis has been diverted. It’s now time to move on to an easier problem—like peace in the

But that may be wrong. The new black cloud on the horizon is the fact that over a hundred thousand middle class people have lost their jobs since 2007, and a huge number of them are now getting to where they are having trouble making payments on their loans. And when that happens, they won’t be able to refinance because their homes will have gone down in value with the first wave of the recession. Many economists are now predicting a Next Big Wave of foreclosures that will take our breath away just when we thought we could start breathing normally again.

Sorry. I meant to bring you some good news.