Stan G. Duncan...

Here's a joke that economists used to tell at conventions, that is, until 2008 when it stopped being funny:

Once upon a time two people were walking along the beach. One looks up and sees an enormous cloud gathering on the horizon. He says, “Hmmm, that looks a lot like a hurricane. Perhaps we should take cover.”

The other says, “Naw, it can’t be. If it was a real hurricane, the sun bathers on the beach would be running and hiding, and nobody’s doing that. Nobody’s acting worried. Therefore it can’t be a hurricane if people aren't acting scared. At worst it’s a mere rain storm.”

Moments later the beach, the bathers, and both walkers were all washed away by the hurricane.

A few months ago Dick Cheney was being interviews on PBS’s The News Hour by Jim Lehrer, and Lehrer asked him why he didn’t see the financial meltdown coming. Cheney responded that “nobody” saw it coming. “Nobody” could have known that this was about to happen. Then he turned to Lehrer and said, “Did you? Did you see it coming?” The truth was, Jim Lehrer did see it coming. He had had numerous people on his show for years reporting that an unnatural bubble in housing and finance was growing out of control and that it would have to eventually pop and would do so with great damage to the economy. But instead of saying that, he politely deflected the question back to Cheney saying, “Well, you’re the Vice President. You are supposed to see these things on the horizon and make plans for them.”

If it had been me, of course, I would have said something like, “Damn straight Mr. Vice President! And I can give you a truckload of names of people who tried to warn you. So, why the hell were you, and that Bush guy who worked for you, so asleep at the wheel?” But then, that’s one of the reasons why Jim is on the air and I’m not.

In actual fact there were a large number of people who saw what was happening and were alarmed about it. In this note I’m going to offer you a laundry list of notables. This isn't something you need to read to the end, but think of it as a resource. You might want to keep the list close to hand so that if one of these people shows up on TV, you will know to pay close attention to what they say.

And also, you never know. One of these days you might be walking down the street and run into Dick Chaney and he might turn to you and say “could anybody have known?” and you can haul out your list and say, "Hell yes. These guys did."

After you've read through the list, I have two questions for discussion. Write me a note if you have an answer (you'll be graded on this):

First, why is it that not one person on this list is from the far right politically? They are all from the moderate left to the far left. What is it about the hermeneutical ideology of progressives that they had the eyes to see and the ears to see what we were doing to ourselves?

And second, an even more interesting question: why is it that not one of these very smart perceptive people, who saw the crash coming, and tried in vain to warn the powers that be about the dangers of it, are employed today in the Obama administration? Instead of calling upon the wisdom of the people who saw the brewing fiasco and called it, why has Obama only hired foxes to clean up the hen house?

Blessings on you all. Here is the list.

Stan

__________________________________________________

a. Nassim Taleb. A political moderate, Greek Orthodox, born in Lebanon, is a mathematician and philosopher who worked for years as a derivatives trader on Wall Street, while growing increasingly critical of its reliance on arcane mathematical models to make financial decisions rather than simple human intuition. He is most famous for his 2006 book,

The Black Swan (which you can find by

clicking here) which is about how things we never believe could happen eventually do happen. Some scientists claimed that it was impossible for nature to create a Black Swan…until one day one was spotted. And Wall Street said it was impossible for the complex web of derivatives trading to ever implode…until one day it did.

Here's a relevant quote from his book:

"The financial ecology is swelling into gigantic, incestuous, bureaucratic banks -- when one fails, they all fall. The increased concentration among banks seems to have the effect of making financial crises less likely, but when they happen they are more global in scale and hit us very hard... I shiver at the thought."b. Paul Krugman. A Nobel Prize winning progressive economist who teaches at MIT and writes for the New York Times. Among other times, in 2005 he wrote

"The U.S. economy is currently suffering from twin imbalances. On one side, domestic spending is swollen by the housing bubble, which has led both to a huge surge in construction and to high consumer spending, as people extract equity from their homes. On the other side, we have a huge trade deficit, which we cover by selling bonds to foreigners. As I like to say, these days Americans make a living by selling each other houses, paid for with money borrowed from China. One way or another, the economy will eventually eliminate both imbalances."[1]

c. Dean Baker. Co-director of the Center for Economic and Policy Research. He has written numerous warnings about the dangers of a housing bubble and the dangers of it bursting, too many times to mention. In 2004, he got so convinced that there was a growing burstable bubble that he sponsored a $1,000 essay contest to see who could write the best argument for why there was not a bubble. The winner’s essay was posted on his web page along with his rebuttal.[2]

Here is a quote from an article in The Nation magazine in 2004:

“At the end of the day, housing can be viewed like Internet stocks on the NASDAQ. A run-up in prices eventually attracts more supply. This takes the form of IPOs on the NASDAQ, and new homes in the housing market. Eventually, there are not enough people to sustain demand, and prices plunge.

The crash of the housing market will not be pretty. It is virtually certain to lead to a second dip to the recession. Even worse, millions of families will see the bulk of their savings disappear as homes in some of the bubble areas lose 30 percent, or more, of their value. Foreclosures, which are already at near record highs, will almost certainly soar to new peaks.[3]

In his column December 15, 2008, he said that Wall Street and the Federal Reserve and the Wall Street Journal and the Washington Post, etc, did not want to hear from people who were bearing bad news about the upcoming train wreck.

“One of the key lessons of this economic crisis should be that there is a remarkable lack of capacity for independent thinking in our most important institutions: government (both the executive and legislative branches), business, the media, and academia. It is possible that an important authority figure could force a re-examination of deeply held views of the world, but we all must recognize that there is a huge amount of dogma to overcome.”

Here’s a link to a 2007

New York Times article about people who saw the crisis coming that focusses mainly on Baker, called “They Cried Wolf. They Were Right.”

d. Robert Kuttner. Editor of

The American Prospect, and columnist for the

Boston Globe. He wrote a really fine article a couple of years ago in

The American Prospect called, “The Bubble Economy.”[4] In it he discussed what he called “the sub prime mess,” what caused it (mainly focusing on a history of deregulation) and where it would take us (a depression). Bob’s a bright guy, but he’s no genius. How come he could see all of that coming and Alan Greenspan said the burst blindsided him?

e. Doris Dengley. I know least about her, except that she is credited as smelling something fishy in the arcane, obtuse, obscurant, Byzantine, financial pages of corporations and wrote about the inherent dangers in them on her blog, “Calculated Risk,” and that she tragically died about a year ago before her prophesies came true.[5]

f. Joseph Stiglitz. Former president of Clinton's panel of economic advisors, chief economist at the World Bank, and Nobel Prize winner in economics. Now teaches at Columbia. He has not been a crusader against the bubble, but has written about it and its potential damage for a long time. Here's a quote from a journal article he wrote for the Economist's Voice. The most telling part of it is the title, "It Doesn't Take Nostradamus."[6]

"I warned roughly two decades ago of the need for greater government regulation of mortgage securitization. I don't think my prediction showed any astounding brilliance. Others no doubt felt similarly. Economic theory--and historical experience--made the risks apparent. Unfortunately, the call for the regulation of mortgage securitization reached deaf ears at that time. Let's hope that this time is different. The next crisis may well be different than the present one, but I'd like to see appropriate regulations that make sure of it. "

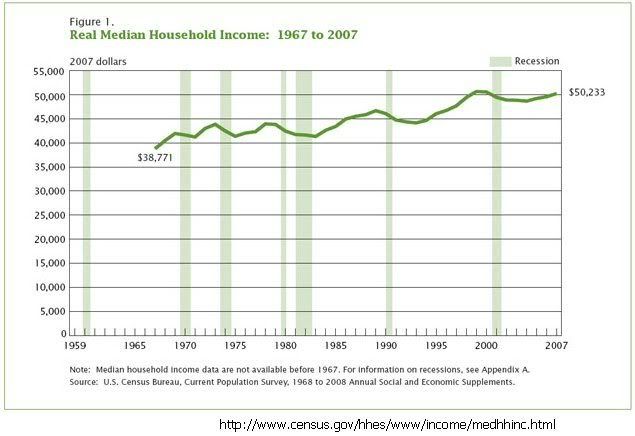

g. Robert Shiller. Professor of economics at Yale. Famous today for predicting both the Dot.com bubble burst of the late 1990s and now the housing and finance bubble of 2007. He did it by tracking housing values (adjusted for inflation) from 1900 on, and finding that prices were remarkably stable—at least until the late 1990s, and they exploded in the 2000s. In the past, every time--emphasize every--time they have gone up, they have eventually come down. This boom would be no exception, he said, and as soon as that happens there will be economic shrapnel all over the American economic landscape.

Here’s a link to a great article about Shiller in 2005 in which he correctly forecasts a recession and a drop in housing prices of forty percent. “Be Warned: Mr. Bubble's Worried Again.”

Relevant quote:

"This is the biggest boom we've ever had," said Mr. Shiller…"So a very plausible scenario is that home-price increases continue for a couple more years, and then we might have a recession and they continue down into negative territory and languish for a decade.

"It doesn't even attract that much attention," he continued. "…even though [by then] prices may have gone down in real terms by 40 percent."

He was right.

Here are some pieces of an interview with him in 2007 on CNN about the bursting of the bubble just before it happened. It can be found here: “Shiller: Mr. Worst-case scenario”[7]

"[T]his is the biggest boom in housing prices since, well, ever. Nothing seems to explain it, and nobody forecast it. It seems to me…human thinking is built around stories, and the story that has sustained the housing boom is that homes are like stocks. Buy one anywhere and it’ll go up. It’s the easiest way to get rich.

From 1890 through 1990, the return on residential real estate was just about zero after inflation. Since 1987 it’s been 6 percent [or about 3 percent a year after inflation]. [but in the last ten years real estate has risen by about 10 percent a year.] It can’t be true that homes rise 10 percent a year. If they did, in the long run no one would be able to afford a house. (In 2005 they went up 14 percent.)

[A $25,000 home in 1957 should be worth roughly $3 million now.] And that flies in the face of common sense. In fact, I’m inclined to think there’s a good chance that the return on real estate will be negative, substantially negative, over the next 10 years because all booms reverse in the end.

Today (July, 2007:…Avoid concentration of risks. You need a house, but I would avoid a second one - or at least avoid an outsize house. Over-investing in real estate now would be a recipe for disaster.

h. William Brennan. A little more than a decade ago, he foresaw the financial collapse of 2008 coming and tried to warn people, but to no avail. As director of the Home Defense Program at the Atlanta Legal Aid Society, he watched as subprime lenders earned enormous profits making mortgages to people who clearly couldn’t afford them. The loans were bad for borrowers — Brennan's experience in working with struggling new home buyers told him that knew that. But he could also see that the loans were eventually going to be bad for all the Wall Street investors who were buying up these shaky mortgages by the thousands. And he spoke up about his fears.

Relevant Quote from his testimony before the Senate Special Committee on Aging in 1998:

“I think this house of cards may tumble some day, and it will mean great losses for the investors who own stock in those companies.”

i. Nouriel Roubini. Professor of international Economics at NYU. Iranian Jew, born in Turkey. Past senior economist for the Council of Economic Advisers for Bill Clinton. As far back as 2005, Roubini was saying that home prices were riding a gigantic speculative wave and that they would soon slide downward and sink the economy. At the same time that Federal Reserve chair, Ben Bernanke was testifying in Congress about how the real-estate problem was "contained," Roubini, bless his heart, was publishing a paper that said that the depressed housing market was nowhere near its bottom and that its contraction would be the worst in decades. His was a very grim prognosis, and was laughed at and called a "Cassandra."

The New York Times belittled him by calling him "Dr. Doom." Because he had the brains to look at reality and say it looks like reality, today he’s considered a sage.

Relevant quotes:

Fall 2007: "The FDIC spent 10% of its reserves to bail out IndyMac, and that was the first in a wave of failures. Will we soon have to bail out the FDIC?"

September 2006, in a report to the IMF: "The United States was likely to face a once-in-a-lifetime housing bust, an oil shock, sharply declining consumer confidence, and, ultimately, a deep recession."

For the best recent article on him, see James Fallows, "Dr. Doom Has Some Good News,"

the Atlantic, July/August 2009.[8]

J. Brooksley Born. Now retired, but during the 1990s, she was the chair of the Commodity Futures Trading Commission (CFTC). She is notable on this list because she tried unsuccessfully to bring over-the-counter financial derivatives under the regulatory control of the CFTC. The government’s failure to regulate such financial deals has been widely criticized as one of the causes of the current financial crisis. In the booming economic climate of the 1990’s, Born battled other regulators in the Clinton Administration, skeptical members of Congress, and lobbyists over the regulation of derivatives. Her argument was that unregulated financial contracts (such as the evil "credit default swaps") could wreck the entire economy. For her efforts to save the world she was vilified by everyone from Wall Street to the Clinton Administration, all of whom who believed deregulation was wonderful and peaceful and kind and a cure all for all economic ills.

A relevant quote from her acceptance speech for receiving the 2009 Profile in Courage Award [9]:

When I spoke out a decade ago about the dangers posed by the rapidly growing and unregulated over-the-counter derivatives market, I did not do so in expectation of award or praise. On the contrary, I was aware that powerful interests in the financial community were opposed to any examination of that market. Yet I spoke out because I felt a duty to let the public, the Congress and the other finan-cial regulators know that that market endangered our financial stability and to make every effort I could to address that problem.

K. Sheila Bair. Head of the Federal Deposit Insurance Corporation. She, like Born, tried hard to sound the alarm within the system, but was resisted and ignored. A good history of her work is found in the words of Caroline Kennedy when she was bestowing (along with Brooksley Born) the 2009 "Profile in Courage" award.

"As early as 2001, then working in the Treasury Department, she saw the potential for abuse in the sub-prime lending business, and urged the industry to adopt a set of best practices to minimize risks to the economy. In 2003, she called for serious reform of the federal regulatory system, arguing that existing policy was insufficient to protect the economy and the public from the risks associated with an increasingly complex and rapidly growing financial industry.

As FDIC Chairman at the height of the bull market in 2007, she again recognized the economic threat posed by subprime loans, and the danger of unchecked greed and negligence by well-connected interests. She proposed that subprime mortgage rates be permanently fixed before they ballooned and forced hundreds of thousands of homeowners into foreclosure. Last July, she halted all foreclosures on loans owned by IndyMac Bank following its failure. And she urged that mortgage relief for distressed homeowners be part of the economic rescue plan of 2008.

She stood up for average, taxpaying Americans, and held her ground under intense criticism from political adversaries. Her efforts to include borrowers in the financial rescue plan met with fierce opposition from other officials in the Bush Administration, who blocked her efforts even as the housing crisis and the economy worsened.[10]

A relevant quote (from her acceptance speech)"

I am very direct. My family tells me that I'm too direct. I wanted to make sure our policies helped the average homeowner on Main Street," said Bair. "We could see the train wreck coming."[11]

---------------------------------------------

Notes

[1] These quotes can be found here: http://www.huffingtonpost.com/arianna-huffington/rewarding-those-who-got-i_b_149388.html. Also see, Paul Krugman, "Lest We Forget," New York Times, November 27, 2008, on why people should have seen it coming, http://www.nytimes.com/2008/11/28/opinion/28krugman.html?_r=2&emc=tnt&tntemail0=y

[2] http://www.bankrate.com/brm/news/mortgages/BakerFamily.asp

[3] Article found here: http://www.thenation.com/doc/20040816/baker Similar others found here: http://www.truthout.org/article/dean-baker-after-housing-bubble-bursts or here: http://www.cepr.net/index.php/op-eds-columns/op-eds-columns/the-housing-bubble-a-time-bomb-in-low-income-communities/ Or here: http://www.cepr.net/index.php/op-eds-columns/op-eds-columns/building-on-the-bubble/. Also see articles in bankrate.com about him here http://www.bankrate.com/brm/news/mortgages/20040422a1.asp.

[4] Robert Kuttner, “The Bubble Economy,” The American Prospect, September 24, 2007. http://www.prospect.org/cs/articles?article=the_bubble_economy

[5] See her long article in 2006 about Citi-Bank at http://calculatedrisk.blogspot.com/2006/12/tanta-let-slip-dogs-of-hell.html

[6] Stiglitz, Joseph E. (2008) "It Doesn't Take Nostradamus," The Economists' Voice: Vol. 5 : Iss. 8, Article 1. Vol. 5 (2008) / Issue 8 / Columns. (http://www.bepress.com/ev/vol5/iss8/art1)

[7] Jason Zweig, “Shiller: Mr. Worst-case scenario” Money Magazine; CNN/Money.com, July 6 2007)

[8]You can also find it online here. http://www.theatlantic.com/doc/200907/roubini

[9] http://www.jfklibrary.org/Education+and+Public+Programs/Profile+in+Courage+Award/Award+Recipients/Brooksley+Born/Acceptance+Speech+by+Brooksley+Born.htm

[10] http://www.jfklibrary.org/Education+and+Public+Programs/Profile+in+Courage+Award/Award+Recipients/Sheila+Bair/Remarks+by+Caroline+Kennedy.htm

[11]http://www.videosurf.com/video/sheila-bair-honored-with-jfk-profile-in-courage-award-66683207